I have been looking to find an entry on gold since the beginning of the year and I think there can be a strong case made from a macro, technical, and fundamental perspective.

Macro Case For Gold

With President Trump regaining office again, we must understand what the promise of income tax reduction does to the economy. If an individual’s taxes are cut, they can spend more money without liabilities.

Without getting into too much detail, lowering interest rates increases consumer spending with liability. Meaning, that consumers take out a loan and have to pay that loan back. Lower interest rates are attractive to consumers because they can get more for the debt that they take on. This type of economic stimulus has less of an impact on inflation (slower too) than something like stimulus checks.

Why did I bring up stimulus checks? I think this example hits close to home because we all saw the direct impact that they had on inflations. An income tax cut for tipped workers would have a similar impact. When considering gold, there are many things to take into account but, one thing is for sure, investors love gold as a store of value when inflation hits.

Fundamental Analysis For Gold

The price for GOLD relative to the SPY is very cheap. I know this is the fundamental analysis section but, if you peep the chart below, you will also notice that GOLD / SPX is at a support level on the bottom of the range.

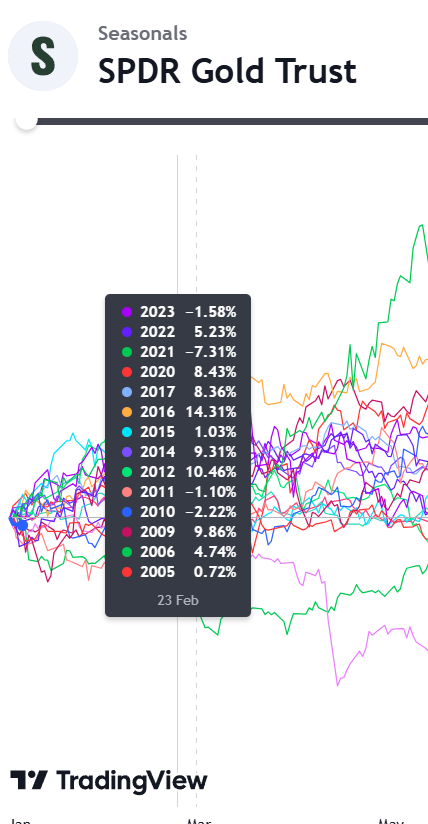

Seasonality

Over the last 18 years, Gold has opened January to about February 23 on an absolute hot streak, returning a negative percentage just 4 times. Even when Gold does not perform well, it is only by a small margin relative to the outperformance of the winners.

Technicals For Gold

Gold has been in an uptrend for some time now, after a strong pullback (which makes me a bit weary), we have an opportunity to enter. Take a look at the chart below, the strong pullback that is mentioned can be explained by those 2 very-large bear bars. This could be an indication that the weekly trend is finally slowing down. If you were to have shorted on the second bar, how would you feel on the next bar? The one labeled, “Bears Did Not Like This.” Not, so happy, right?

My thoughts exactly! The longer-term bears we not very happy and certainly the smart ones got out while they could. What happens next is a consolidation where market participants settled on a price range… for now!

Conclusion

Gold is setting up for a solid play in a long-term portfolio. It could offer some nice returns. If you take a look at my Risk / Reward profile you can see what I am eyeballing for an entry vs take profit. While this can change, it will not be by much. If we never hit the entry and bullish inside bar forms this week, I will like next week’s entry even more.

Leave a Reply